Understanding Forex Trading Patterns: A Comprehensive Guide

In the world of Forex trading, understanding price movements is crucial. Traders utilize various tools and strategies to analyze market trends and make informed decisions. Among the most effective tools are Forex trading patterns. These patterns help traders to predict future price movements based on historical data. In this article, we will delve into different types of Forex trading patterns, their characteristics, and practical examples, along with tips on how to effectively implement them in your trading strategy. For traders looking to start their journey, visiting reputable sources like forex trading patterns Forex Brokers in Uzbekistan can be beneficial.

What Are Forex Trading Patterns?

Forex trading patterns are specific formations created by the price movements of currency pairs over a defined period. These patterns typically occur frequently and can indicate potential continuation or reversal trends. By recognizing these patterns, traders can make educated predictions about the direction of future price movements. Understanding these patterns is essential for developing a successful trading strategy.

Main Types of Forex Trading Patterns

1. Continuation Patterns

Continuation patterns indicate that a current trend will likely continue after a brief period of consolidation. Traders often use these patterns to identify opportune moments to enter the market when the trend resumes. The most common continuation patterns include:

- Flags: Typically, flags are short-term patterns that resemble a small rectangle or parallelogram that forms during a strong trend. They indicate a pause before the trend continues.

- Pennants: Similar to flags, pennants form during a price consolidation before the previous trend resumes. They appear as a symmetrical triangle, converging the price action.

- Triangles: Triangle patterns can be either ascending, descending, or symmetrical and indicate a continuation of trends based on their breakout direction.

2. Reversal Patterns

Reversal patterns suggest that the current trend may be coming to an end, paving the way for a price reversal. Recognizing these patterns can provide traders with opportunities to capitalize on trend reversals. Common reversal patterns include:

- Head and Shoulders: This pattern consists of three peaks: a higher peak (the head) between two lower peaks (the shoulders). It signals a bearish reversal.

- Inverse Head and Shoulders: The opposite of the head and shoulders pattern, it signals a bullish reversal. It consists of three troughs, with the middle one being the lowest.

- Double Tops and Bottoms: A double top signals a reversal after an uptrend and resembles an “M” shape, while a double bottom indicates a bullish reversal after a downtrend resembling a “W” shape.

How to Trade Using Forex Patterns

Understanding Forex trading patterns is one thing; applying them effectively is another. Here are some steps and strategies to consider when trading using these patterns:

1. Identify the Patterns

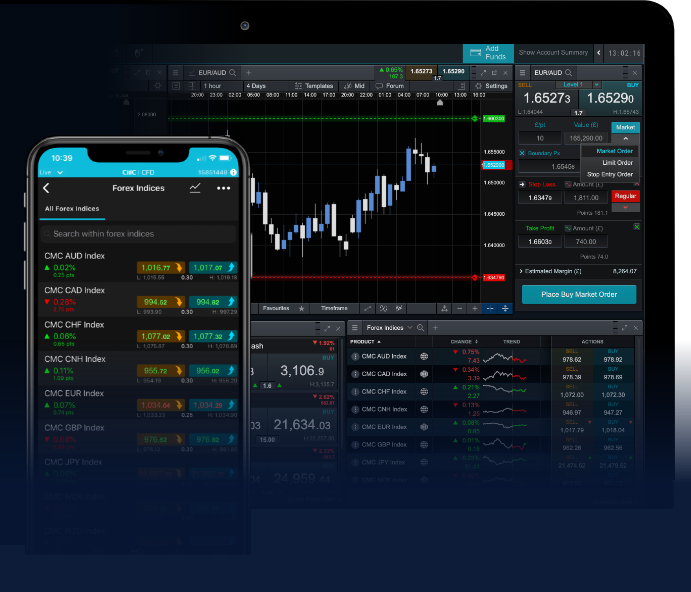

First and foremost, develop your skills in identifying various patterns. Use historical charts to practice recognizing these formations. Trading platforms often come with tools that help in spotting chart patterns.

2. Confirm with Volume

Volume analysis is a critical component of validating patterns. An increase in trading volume can confirm the authenticity of a breakout. For example, if a price breaks above a resistance level following a bullish pattern, a corresponding increase in volume lends credibility to the move.

3. Implement Risk Management Strategies

Before entering a trade based on a pattern, define your risk management strategy. Setting stop-loss orders can help minimize losses. Additionally, consider the risk-reward ratio. Aim for trades where potential reward outweighs risk.

4. Combine with Other Indicators

Many successful traders use a combination of methods to enhance their trading strategies. Pairing Forex patterns with technical indicators like Moving Averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence) can provide a clearer picture.

Conclusion

Forex trading patterns are invaluable tools for traders seeking to enhance their market analysis and decision-making processes. From identifying continuation and reversal patterns to implementing comprehensive trading strategies, understanding these patterns can significantly improve your trading performance. Mastering Forex patterns takes practice, but with dedication and the right approach, traders can create systematic and profitable trading strategies. Remember, the Forex market is a dynamic environment, and continuous learning is key to success. Happy trading!