Digital Banks Take a Stand Against Gambling: Understanding the Block on Gambling Transactions

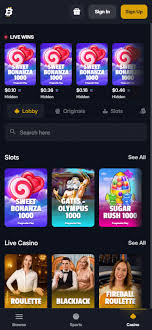

In recent years, the digital banking landscape has experienced significant transformation, particularly regarding how financial institutions manage risk and promote responsible spending. Among the emerging trends is the decision by many digital banks to block transactions related to gambling. This initiative is largely driven by the growing concerns around gambling addiction and its societal impacts. In this context, services such as Digital Banks Blocking Gambling Spend: Ethical or Not? Bitfortune APK are also impacted by these banking policies, as they rely on transactions that some banks may consider risky.

Understanding Digital Banks

Digital banks are financial institutions that operate exclusively online, providing services such as savings accounts, loans, and payment processing without the need for physical branches. Their inception has dramatically transformed the banking experience, allowing customers to manage their finances from their smartphones or computers with ease. This shift attests to technological advancements that bring convenience, but it also places a greater responsibility on banks to monitor and manage financial behaviors that may lead to harmful consequences.

The Rationale Behind Blocking Gambling Transactions

The decision to block gambling transactions stems from both ethical considerations and risk management strategies. Gambling can lead to significant financial losses and addiction for some individuals, prompting banks to take preventative actions. The following factors contribute to this trend:

- Consumer Protection: Digital banks aim to provide a safe banking environment. Blocking gambling transactions can help prevent customers from incurring excessive debts and possibly falling into financial duress.

- Regulatory Compliance: Governments worldwide are increasingly scrutinizing the gambling industry. Banks must adhere to regulations designed to protect consumers from gambling-related harms.

- Risk Management: High-risk transactions can threaten a bank’s financial stability. By controlling gambling spends, banks can mitigate their exposure to potential losses linked to excessive gambling behaviors among customers.

Impact on Consumers

The blocking of gambling transactions by digital banks carries various implications for consumers:

- Accessibility: For non-addictive gamblers, the restrictions can be inconvenient as they may interfere with their ability to engage in lawful entertainment options, like online casinos or betting platforms.

- Awareness and Education: Consumers may benefit from increased awareness of the risks associated with gambling due to the bank’s stance. This can encourage more responsible behaviors and encourage individuals to seek help if needed.

- Financial Literacy: The restrictions could spark broader discussions about financial management and responsible spending, enabling consumers to make informed decisions when it comes to their finances.

The Effect on the Gambling Industry

The gambling industry is undoubtedly influenced by the banking policies against gambling transactions. The following points illustrate the potential repercussions:

- Shift in Consumer Behavior: With increasing barriers to gambling-related transactions, consumers may seek alternative methods or platforms that are less affected by these restrictions, impacting the revenue of established gambling operators.

- Adoption of Alternative Payment Methods: To bypass transaction restrictions imposed by banks, gambling platforms may rely more heavily on digital wallets or cryptocurrencies, which can complicate regulatory compliance.

- Market Dynamics: These changes can lead to shifts in market dynamics, with providers needing to innovate their offerings and adapt to the evolving landscape of consumer preferences and banking regulations.

Future Developments

As society becomes increasingly aware of the risks associated with gambling, the trend of digital banks blocking these transactions may continue to expand. Future developments in technology and regulation may shape how both banks and gambling platforms interact with each other and their consumers:

- Enhanced Analytics: Digital banks may leverage advanced data analytics techniques to identify and flag risky consumer behavior, allowing for more proactive engagement and personalized financial solutions.

- Collaboration with Gambling Services: Some digital banks may choose to forge partnerships with gambling platforms to promote responsible gambling, offering tools or resources that encourage safer betting practices.

- Regulatory Changes: The industry landscape might evolve as governing bodies adjust regulations to address the changing norms around gambling and financial transactions, including the potential for new standards in responsible gambling.

Conclusion

The trend of digital banks blocking gambling transactions is a reflection of heightened awareness regarding the impacts of gambling on individual consumers and society as a whole. Balancing consumer protection, regulatory compliance, and risk management is paramount for these institutions. While this may create challenges for consumers who gamble responsibly, it also underscores the importance of promoting responsible spending habits and increasing education regarding financial management. As the conversation around gambling, technology, and banking evolves, stakeholders across the industry will need to adapt to ensure they meet the demands of consumers while fostering a responsible gambling environment.