Online forex trading has become increasingly popular in recent years, attracting millions of traders from around the world. As the largest financial market globally, the foreign exchange market offers unparalleled opportunities for profit and growth. If you’re looking to navigate this market successfully, it’s crucial to understand its dynamics, fundamental principles, and the right tools to use. Furthermore, platforms like online forex trading South Africa Brokers can provide valuable assistance for traders entering this thrilling arena.

What is Forex Trading?

Forex, short for foreign exchange, refers to the trading of currencies. Unlike traditional stock markets, the forex market operates globally, and trading is conducted 24 hours a day, five days a week. In the modern era, online forex trading has made it easier for individual traders to enter the market, thanks to advancements in technology and the proliferation of online trading platforms.

The Basics of Forex Trading

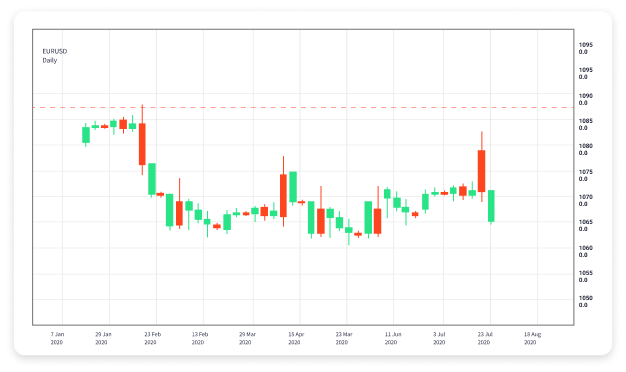

When trading forex, you buy one currency while simultaneously selling another. Currencies are traded in pairs, such as EUR/USD or GBP/JPY. The price of a currency pair reflects how much of the second currency is needed to purchase one unit of the first currency. For instance, if the EUR/USD pair is trading at 1.20, it means that 1 Euro is equal to 1.20 US Dollars.

Understanding Currency Pairs

Currency pairs are classified into three categories: major, minor, and exotic pairs. Major pairs include the most frequently traded currencies and often have lower spreads, making them more suitable for beginners. Minor pairs consist of less traded currencies, while exotic pairs involve a major currency paired with one from a developing economy.

Key Concepts in Forex Trading

Pips and Lots

A pip is the smallest price movement that a given exchange rate can make based on market convention. In most currency pairs, this is represented by the fourth decimal place. A “lot” refers to the size of a trade, and there are standard lots (100,000 units), mini lots (10,000 units), and micro lots (1,000 units). Understanding these concepts is essential for managing your risk and positioning in the market.

Leverage

Leverage allows traders to control a larger position than their actual capital. It is a double-edged sword; while it can amplify your profits, it can also exacerbate losses. Leverage ratios can vary widely among brokers, so choosing wisely is imperative.

Developing a Trading Strategy

Successful forex trading requires a solid strategy. There are various approaches, including day trading, swing trading, and position trading. Let’s explore these strategies briefly:

Day Trading

Day traders buy and sell currencies within the same trading day. This strategy requires constant monitoring of the market and quick decision-making. It’s suitable for those looking to capitalize on intraday price movements.

Swing Trading

Swing traders hold positions for several days or weeks, aiming to profit from price swings. This strategy allows for a more relaxed trading style, as it does not require constant monitoring.

Position Trading

Position trading involves holding a trade for an extended period, often based on fundamental analysis. This strategy is less concerned with short-term fluctuations and more focused on long-term market trends.

Tools of the Trade

Several tools and resources can enhance your trading experience. These include:

- Trading Platforms: Choosing a robust trading platform is vital. Look for features such as user-friendly interfaces, advanced charting tools, and reliable customer support.

- Technical Analysis: Utilizing technical indicators and chart patterns can help forecast price movements. Popular indicators include Moving Averages, Relative Strength Index (RSI), and Bollinger Bands.

- Economic Calendars: Staying informed about economic events like interest rate decisions, inflation reports, and employment data can significantly influence currency prices.

Risk Management in Forex Trading

Managing risk is crucial in forex trading. Traders should define their risk tolerance, use stop-loss orders, and never risk more than they can afford to lose. Risk management ensures longevity in the trading business.

Tips for Success in Forex Trading

- Educate Yourself: Continuous learning about market trends, strategies, and tools is essential.

- Practice with a Demo Account: Most brokers offer demo accounts. Use them to practice without risking real money.

- Stay Emotionally Detached: Avoid making impulsive decisions based on fear or greed.

- Analyze Your Trades: Keep a trading journal to evaluate your past trades and learn from both successes and failures.

Conclusion

Online forex trading presents both opportunities and challenges. By understanding the market’s mechanics, developing a thoughtful trading strategy, and practicing effective risk management, traders can successfully navigate this vibrant financial landscape. Whether you are a beginner or an experienced trader, the key is to stay informed, disciplined, and adaptable to market conditions. With the right approach, online forex trading can indeed be a rewarding endeavor.